The year was 1944. FDR was President, the Allies had invaded France, and the US Department of Veterans Affairs was launching a program that would reward the country’s most sacrificial citizens with assistance in the area of homeownership. 73 years later, not only have the the VA’s little-known mortgage option has not expired, but historically low interest rates have made them more valuable than ever.

The year was 1944. FDR was President, the Allies had invaded France, and the US Department of Veterans Affairs was launching a program that would reward the country’s most sacrificial citizens with assistance in the area of homeownership. 73 years later, not only have the the VA’s little-known mortgage option has not expired, but historically low interest rates have made them more valuable than ever.

Thanks to your service, no PMI insurance & no downpayment is required.

A typical homeowner with less than 20% equity would be required to pay for PMI (private mortgage insurance), but there’s one exclusion: veterans. Through the VA’s refinance program, no PMI is required. That factor alone could put hundreds of dollars back in your pocket each month. What’s even more impressive is that when you purchase a home you don’t need to have a downpayment if you qualify.

QUICK NOTE: Even if you have a conventional mortgage, a reputable lender can help you switch to a mortgage with VA benefits. Calculate your new payment HERE ››

Options for Opportunity.

The VA’s mortgage program is designed to empower Veteran homeowners with a better mortgage and the options available to Veterans may surprise you. Every homeowner is aware of our grandfather’s mortgage, the 30 year fixed loan. What most people don’t realize is there are many more options for veterans including:

- 25 year-fixed

- 20 year-fixed

- 15 year-fixed

- 10 year-fixed

- Adjustable rate mortgages with special government caps.

What is our favorite of the bunch? Hands down it’s the 15-year VA mortgage.

Veterans: Cut your home’s interest by 72%.

If you took out a 30-year mortgage on your home, you’re not alone. And you could be paying tens of thousands of dollars in unnecessary interest over the course of your loan. But not to worry. The VA’s Refinance program is designed to empower Veteran homeowners with a better mortgage.

The secret? Take back the power of compound interest.

A 15-year mortgage crushes a 30-year mortgage on two overlapping fronts: interest over time, and interest rates. A 15-year mortgage has lower interest rates than a 30-year and cuts the length of the interest’s growth in half. The bottom line: MorningFinance found that 72% of an employee’s monthly payment on a 30-year mortgage was pure interest. When a member of the Morning Finance team plugged his information into LendingTree’s secure platform, he was shocked by the result. By switching from a 30- to a 15-year fixed rate mortgage, he unlocked $159,447.09 in savings. This logic isn’t just for VA mortgages, it applies to regular mortgage loans too.

PRO TIP: Even if you have a conventional mortgage, a reputable lender can help you switch to a VA backed mortgage. Calculate your new payment here ›››

Qualify today and you may receive cash back.

When you refinance, you’ll receive a refund of any escrow you’ve accumulated. For our colleague, he received $1777 in a cash escrow refund and was allowed two payment-free months of blissful homeownership.

Claim your VA mortgage now.

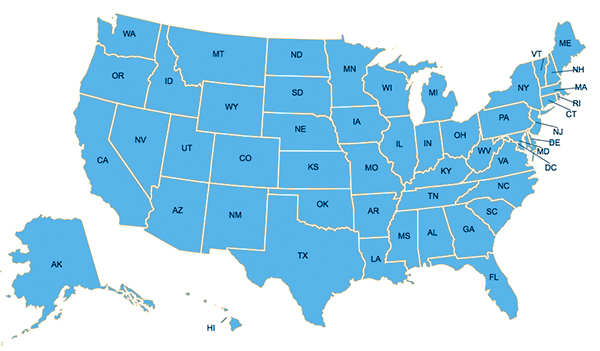

There’s only one way to know for sure if you can take advantage of this exclusive offer from the US Department of Veteran’s Affairs. See if you qualify for this exceptional offer by clicking on your state in the map below.